AI that works with your close

Double’s AI helps you move faster during the close, without giving up review, control, or accountability.

Get started

Trusted by thousands of bookkeepers and accountants

AI Built Around The Close

Automates the busywork, not the judgment

Double focuses on the repetitive, time‑consuming parts of the close, while keeping professional judgment firmly with the accountant.

Double focuses on the repetitive, time‑consuming parts of the close, while keeping professional judgment firmly with the accountant.

Designed for human review and sign‑off

Every close is reviewed and approved by a human, so AI output is always clear, explainable, and easy to verify.

Every close is reviewed and approved by a human, so AI output is always clear, explainable, and easy to verify.

Built into real accounting workflows

AI lives inside the workflows accountants already use, not inside a separate black‑box tool.

AI lives inside the workflows accountants already use, not inside a separate black‑box tool.

Surfaces what matters, then gets out of the way

AI organizes the work and flags what needs attention, helping you move faster without taking control away.

AI organizes the work and flags what needs attention, helping you move faster without taking control away.

Learn more about our AI philosphy

Accelerate this month's close

Automated organization, human-approved posting

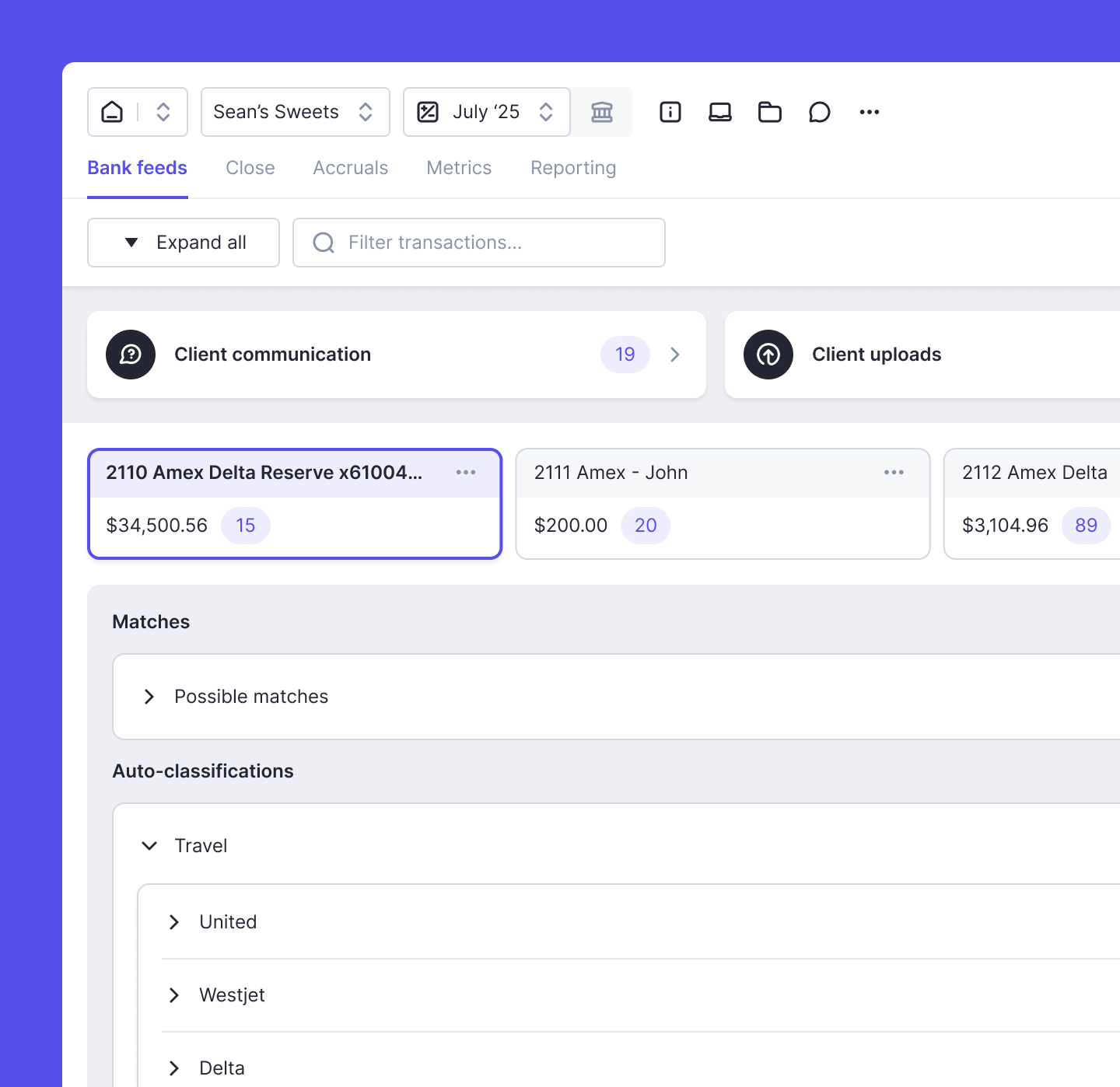

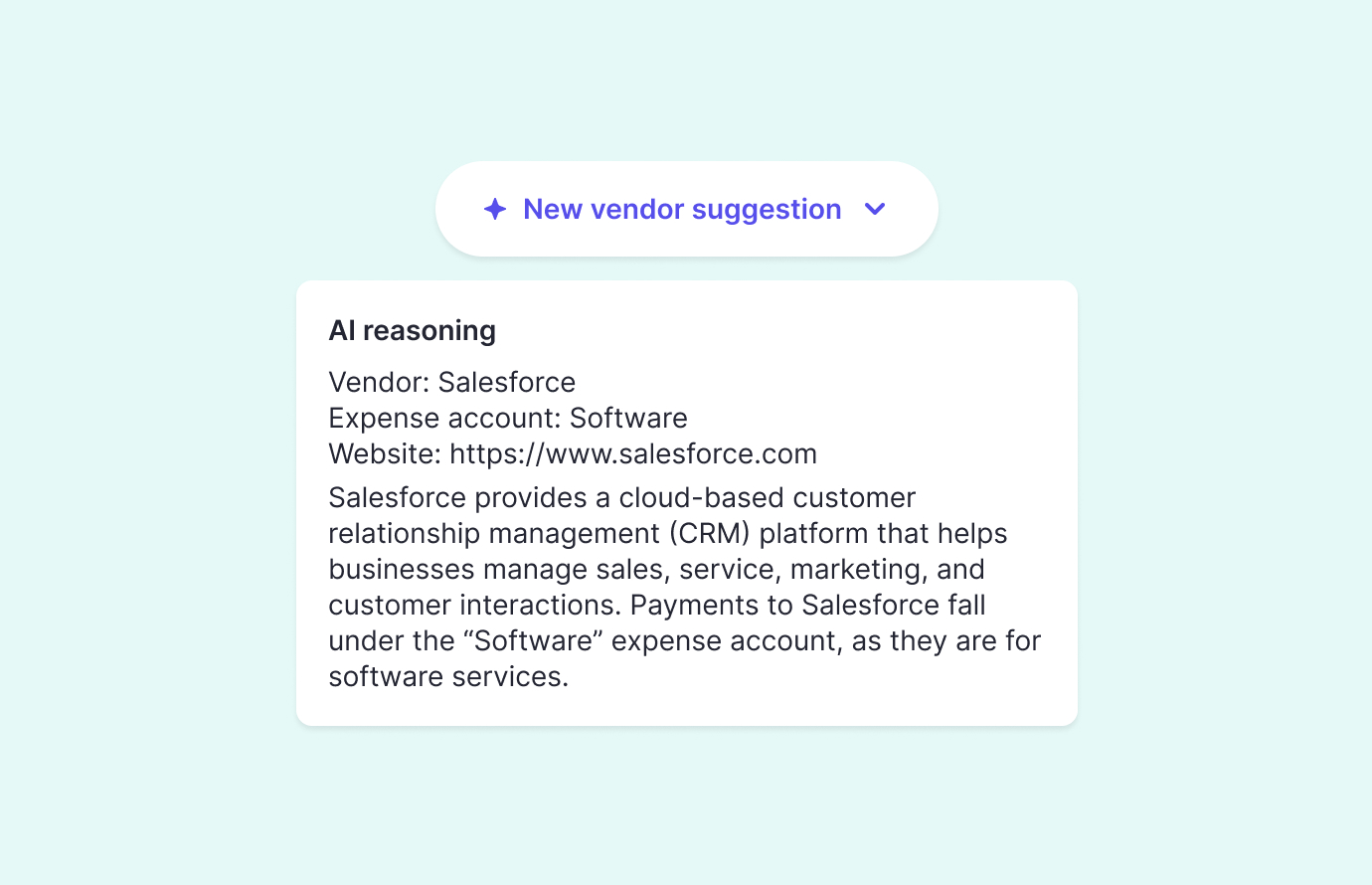

AI Bank Feeds

Double's bank feeds organize bank activity the way bookkeepers already work.

Transactions are automatically grouped into matches, rules, auto-classifications, and needs review. The system uses your historical ledger behavior to make high and medium-confidence recommendations.

Anything uncertain or new is flagged, with suggested categorizations based on vendor lookups and prior behavior.

Transactions are automatically grouped into matches, rules, auto-classifications, and needs review. The system uses your historical ledger behavior to make high and medium-confidence recommendations.

Anything uncertain or new is flagged, with suggested categorizations based on vendor lookups and prior behavior.

Learn more about AI bank feeds

Drafted entries, ready for review

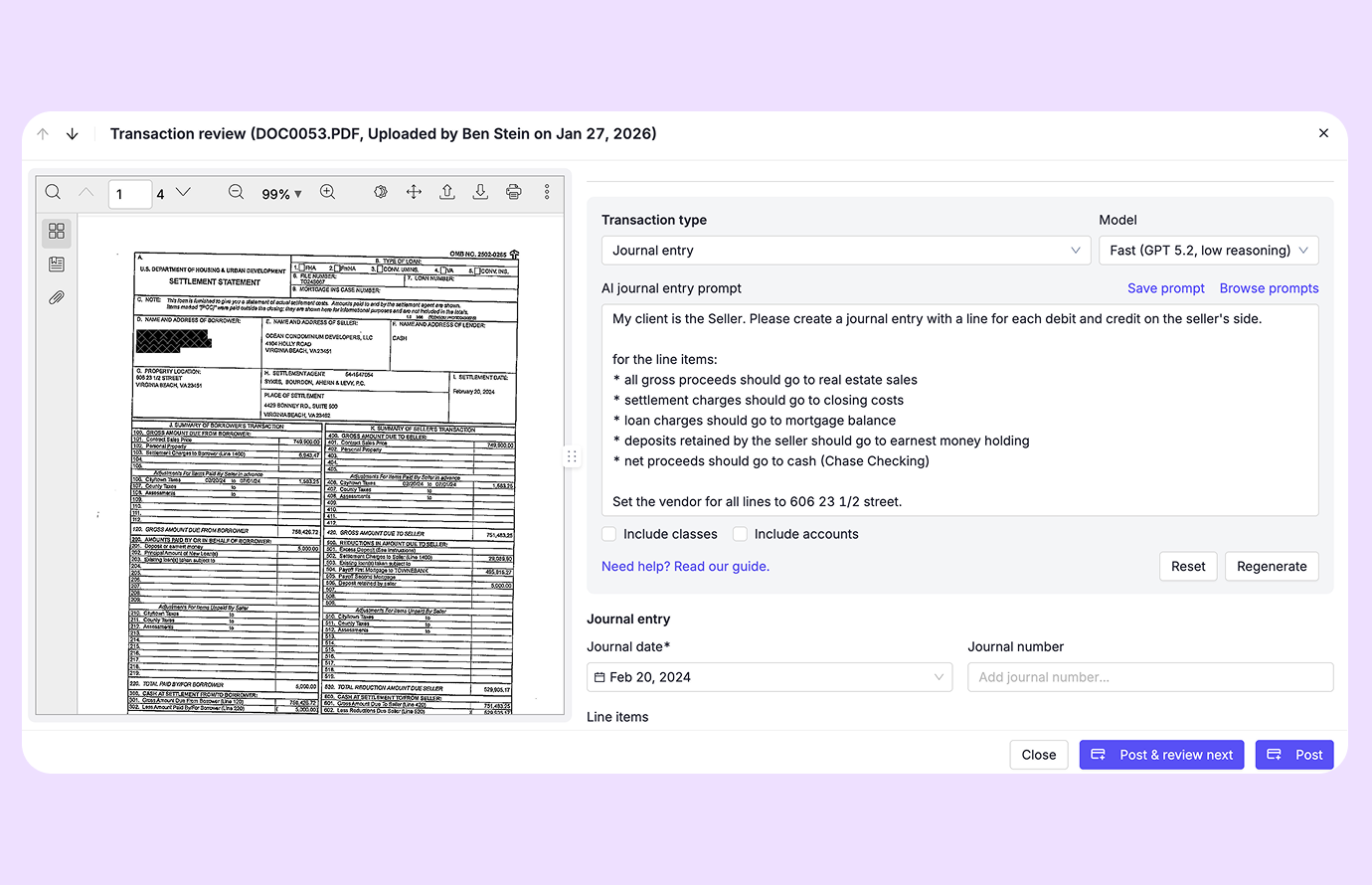

AI Journal Entries

AI journal entries turns a frustrating, manual chore into a streamlined, guided workflow that's faster, cleaner, and easier to review.

Turn source files into journal entries in minutes by automating the conversion of complex documents like payroll reports and HUD-1 settlements into ready-to-post journal entries.

Reduce errors and tie-out issues with AI-generated, balanced entries that minimize manual mistakes and rework.

Streamline your workflow by reviewing, adjusting, and posting journal entries directly within Double without switching between tools.

Turn source files into journal entries in minutes by automating the conversion of complex documents like payroll reports and HUD-1 settlements into ready-to-post journal entries.

Reduce errors and tie-out issues with AI-generated, balanced entries that minimize manual mistakes and rework.

Streamline your workflow by reviewing, adjusting, and posting journal entries directly within Double without switching between tools.

Learn more about AI journal entries

Clear explanations of what changed

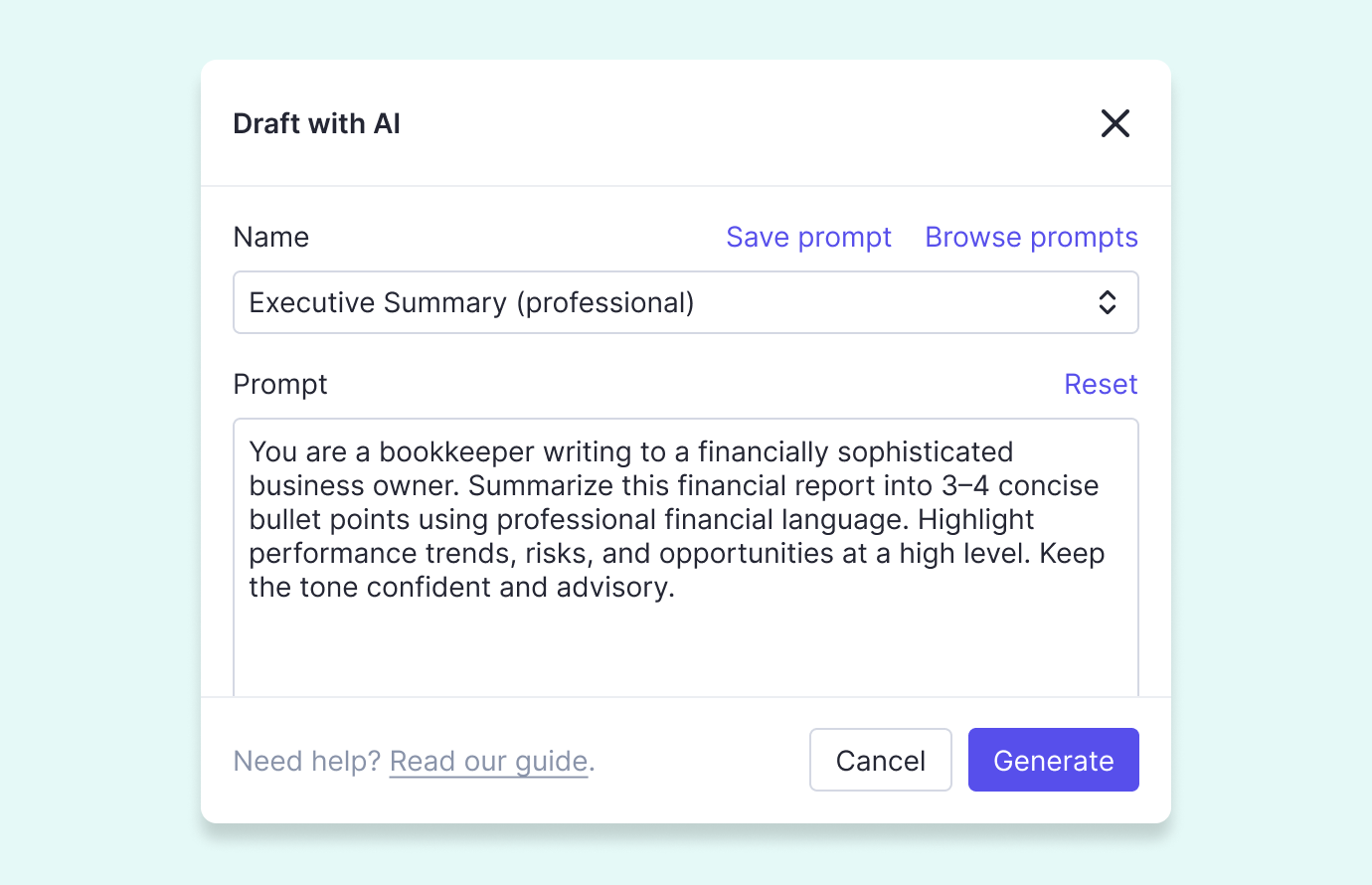

AI Financial Summaries

Give clients more than just numbers—give them meaning.

AI financial summaries automatically generate clear, client-ready commentary that highlights key trends, variances, and areas to watch.

Flexible prompts make it easy to tailor tone and content per client, so you can deliver deeper insights in minutes, not hours.

AI financial summaries automatically generate clear, client-ready commentary that highlights key trends, variances, and areas to watch.

Flexible prompts make it easy to tailor tone and content per client, so you can deliver deeper insights in minutes, not hours.

Learn more about reporting in Double

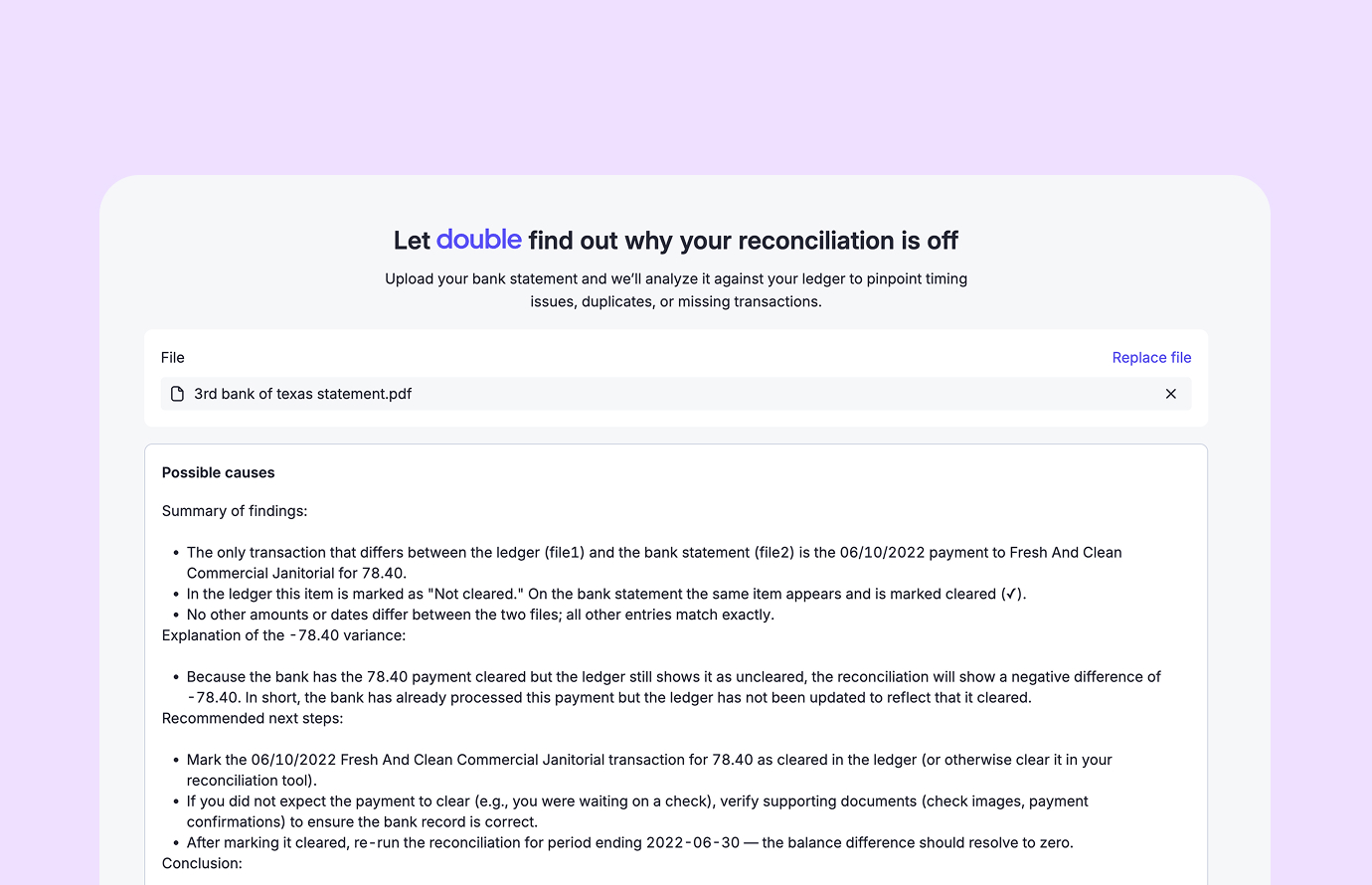

Faster answers when reconciliations don’t tie

AI‑assisted Reconciliations

When a reconciliation doesn’t tie, Double’s AI is there to help. With one click, you can analyze the difference by comparing your bank or credit card statement directly against the ledger to pinpoint what’s causing the discrepancy.

AI surfaces the specific transactions that need attention and tells you exactly what action will resolve the difference.

The one-to-two hour reconciliation rabbit holes become quick, targeted fixes, without slowing down the recs that already work.

AI surfaces the specific transactions that need attention and tells you exactly what action will resolve the difference.

The one-to-two hour reconciliation rabbit holes become quick, targeted fixes, without slowing down the recs that already work.