1099s

Track and prepare 1099s

Equip your team with tools to identify vendors and collect W-9s all year long, so you can avoid the January-induced headache.

Get started

Trusted by thousands of bookkeepers and accountants

Got 1099 problems?

Identify

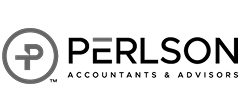

Double's Prepare 1099s Report integrates with your client’s QuickBooks/Xero ledger and identifies vendors that meet the reporting threshold. Credit card transactions are excluded by default.

“It’s so easy to let a client know we need a W-9 and when it comes directly from the vendor, it’s so smooth! Double helps us catch missing W-9s immediately. We expect to cut down the amount of time we spend chasing W-9s at the end of the year by two-thirds or more. ”

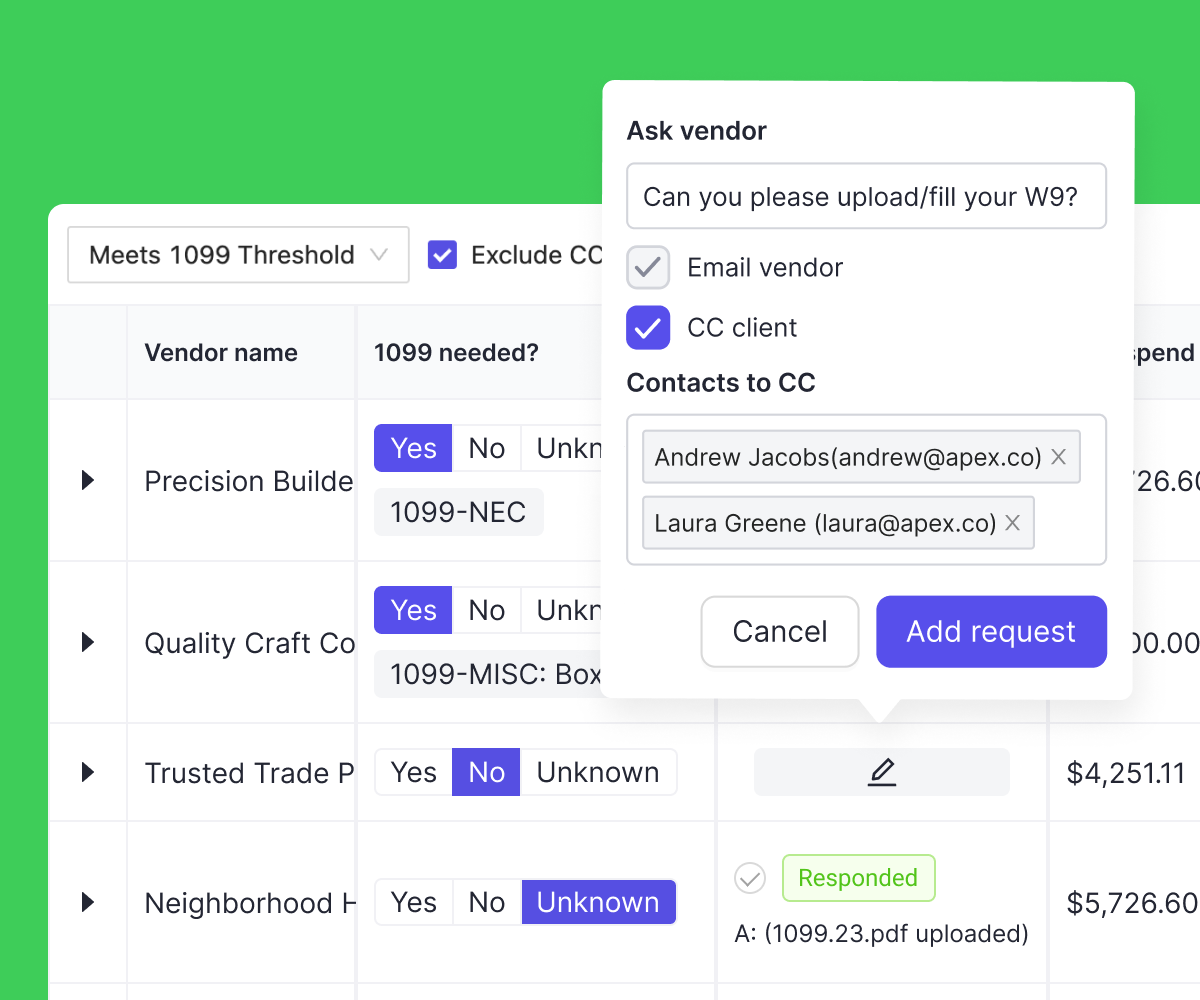

Request

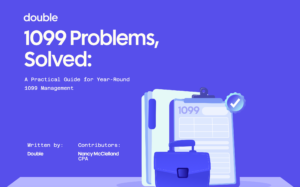

If a 1099-eligible vendor is missing a W-9 – you can use the Client Portal to request it from your clients, or from the vendors directly. Stay on top of W-9 requests all year long and build the task into your monthly workflow, using the newly added vendors report.

All your 1099 questions answered for 2026

Get the ebook

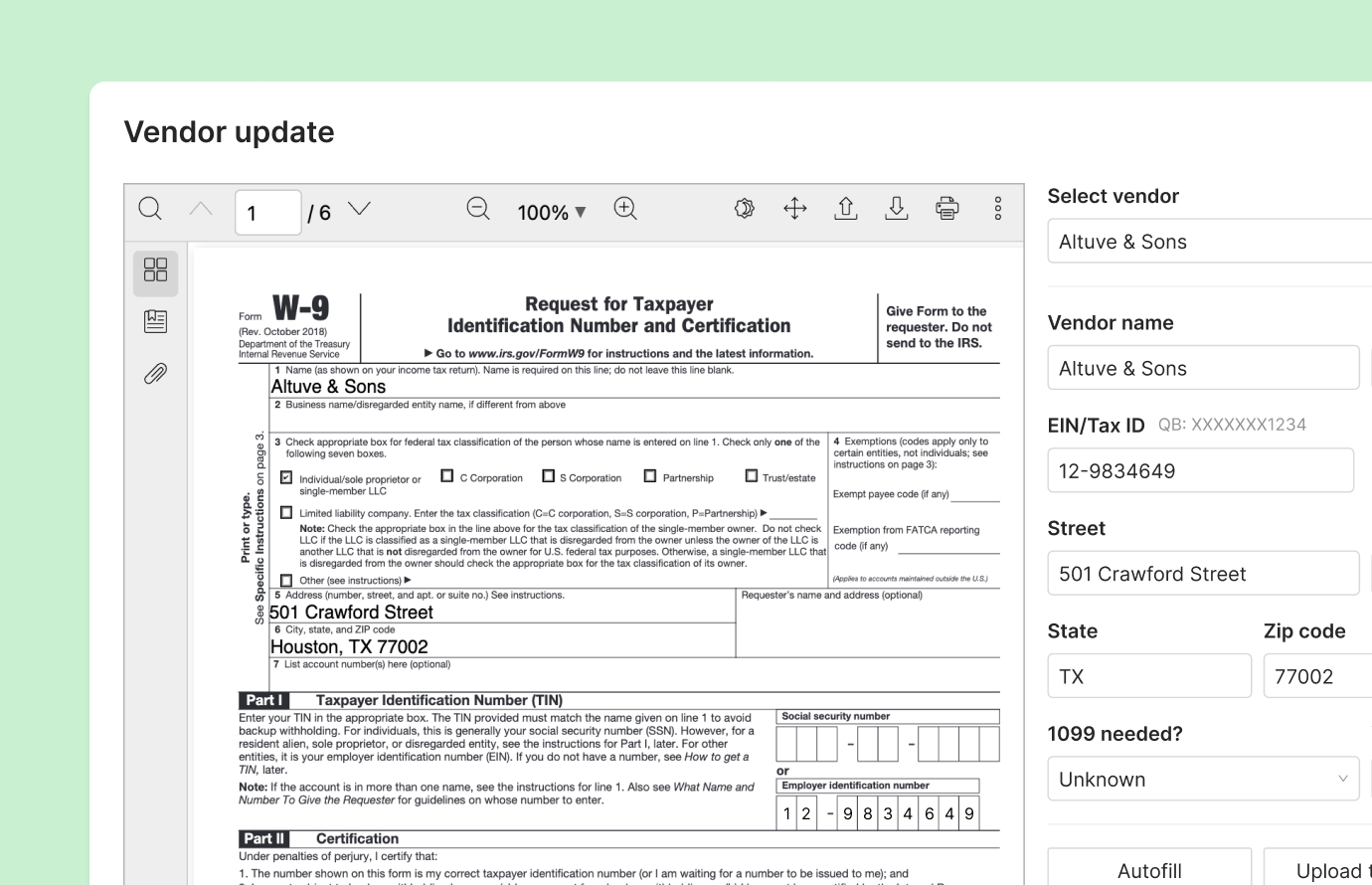

Update

Once the vendor provides a W-9, you can update that data within Double and it will sync back to QuickBooks Online and Xero instantly.

Explore File Reviews

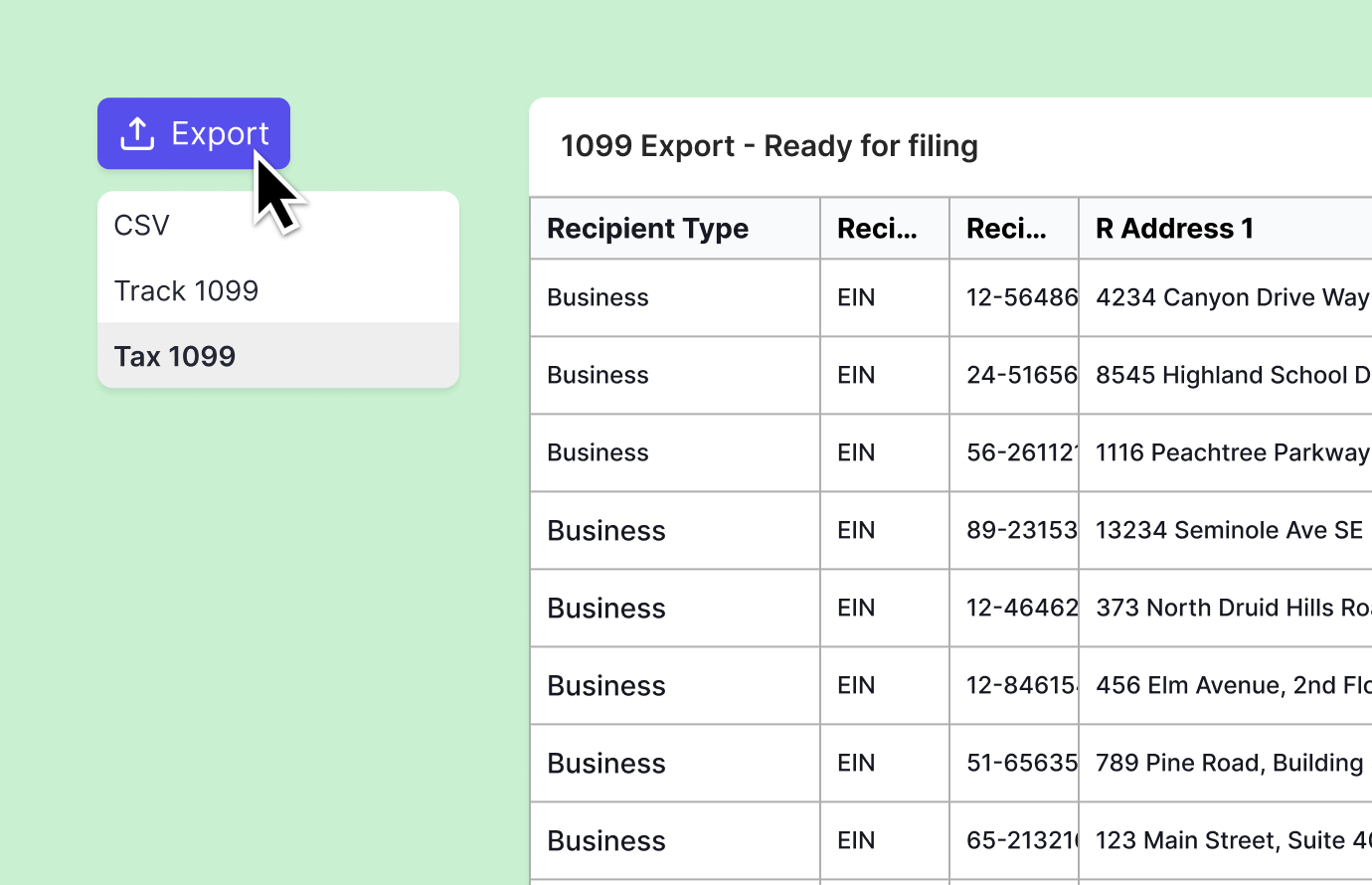

Export

Export all 1099-related data (in your preferred file format) to Track1099 or Tax1099 for filing.