Introduction

Month-end close is one of the most stressful parts of the accounting cycle and accruals are a big reason why. Prepaid expenses, fixed assets, and revenue recognition are critical for accurate reporting, but tracking them has traditionally meant juggling spreadsheets,

manual formulas, and late-night reconciliations.

In recent years, specialized tools have emerged to ease this burden, automating portions of the accrual entry process. For firms still buried in spreadsheets, that’s been a meaningful step forward.

But here’s the catch:

accruals don’t live in a vacuum. They touch reporting, client records, and audits. When they’re managed in a silo, firms often trade one problem (manual work) for another (fragmentation).

That’s why we built

our accruals feature; not just to automate accruals, but to integrate them into the entire close.

Integrated, not isolated

Point solutions have done important work in moving firms past spreadsheets. They make it easier to post journal entries, cut down on repetitive data entry, and give teams a faster way to handle accruals. For many firms, that has been the first step toward modernizing the close.

But when accruals are managed outside the broader workflow, new challenges emerge: disconnected processes, extra vendors to manage, and reports that do not align with the rest of the close.

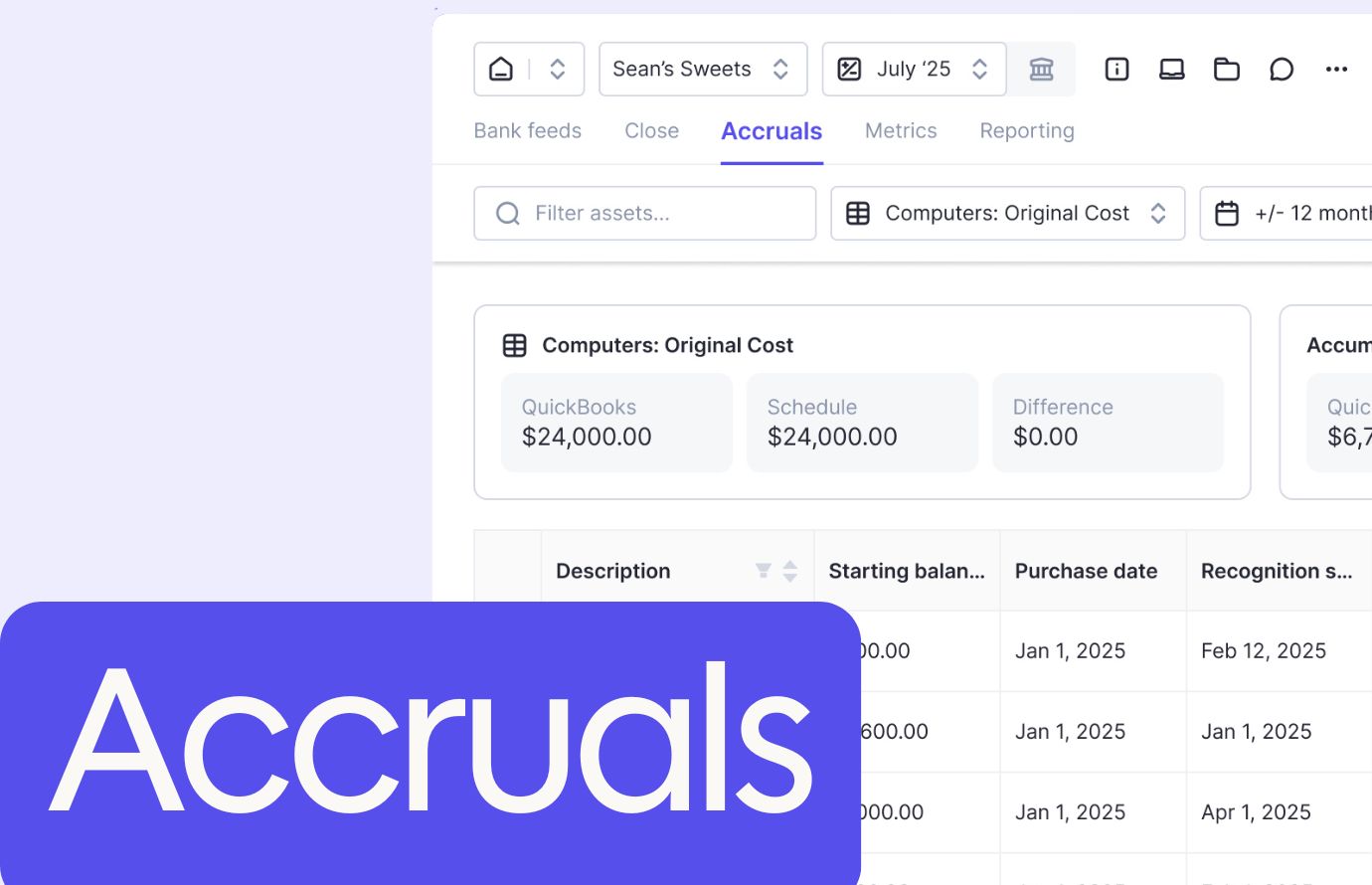

Using Double for accruals means taking a different approach. Accruals in Double are

part of the same system you already use for trial balances, client communication, and reviewing tasks. No extra logins. No reconciling across platforms.

Beyond expense accruals

Many standalone tools shine in the world of expense accruals, and for good reason: they’re the most common and the easiest to automate. Standardizing recurring expenses can eliminate hours of manual work, and for firms coming from spreadsheets, that’s a huge step forward.

But expense accruals are just the beginning. The real power comes from extending automation across the rest of the balance sheet:

- Prepaids: automate amortization schedules without Excel

- Fixed assets: track original cost, accumulated depreciation, and reversals

- Revenue recognition: align recognition schedules directly with your close

- Payroll accruals: seamlessly capture payroll liabilities

- Accrued expenses: standardize and automate recurring obligations

The result is a

complete, connected view of the balance sheet, not just a slice of it.

Built for the workflow

Accruals don’t stop with a journal entry. Double ingests schedules from CSVs, automatically normalizes and validates the data, then generates schedules using methods like straight-line or mid-month. A centralized Accruals tab keeps everything visible in one place, ready to export for audit. And because every change is logged, the audit trail is already built in. With Double, accruals aren’t just automated, they’re audit-ready by default.

Pricing: predictable vs. variable

Another major difference comes down to cost.

Point solutions often charge based on the

number of accruals per month, with a lower price point for entry, but unlimited accruals come in at close to $200. On paper, that seems flexible. In practice, it gets expensive quickly. Most firms we've spoken with easily exceed 50 accruals in a single month, which pushes them into the higher tiers, often close to $200 every month, just for accruals.

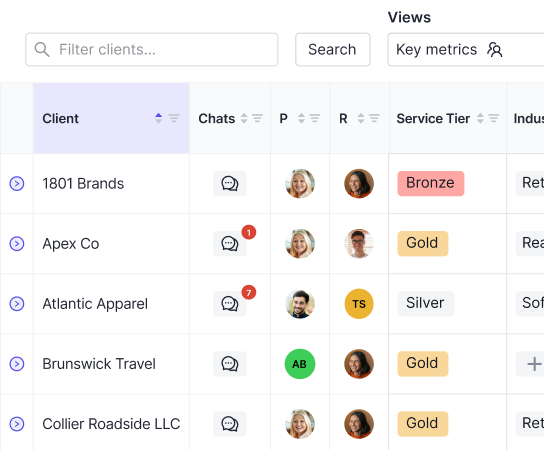

Double takes a different approach.

Unlimited accruals are built into our flat $50 per-client monthly fee, included with Double's highest tier. That one price covers everything you need for accrual management - plus all of Double's other functionality!

The result is

simple, predictable pricing that scales with your clients, not with the number of journal entries you book.

Why this matters for growing firms

At a small scale, firms can manage with spreadsheets or single-purpose tools. But as practices expand, the cracks appear: duplicate data entry, mismatched numbers, and clients questioning why reports don’t tie out.

By keeping accruals inside the same platform as the rest of the close, firms avoid these pain points. There is less reconciliation work, fewer opportunities for manual errors, and clearer visibility for both teams and auditors. Most importantly, the process scales without adding complexity, giving firms the confidence to grow without being held back by their systems.

The bigger picture

Point solutions showed the industry there’s demand for automating accruals. The next step is clear: integration. Firms don’t just want automation for one process, they want a unified workflow that brings every part of the close together.

That’s the difference with Double. Accruals aren’t another silo. They’re part of a single source of truth, built to scale with your firm.

Because at the end of the day, it’s not just about closing the books faster. It’s about closing them

smarter, cleaner, and with confidence.