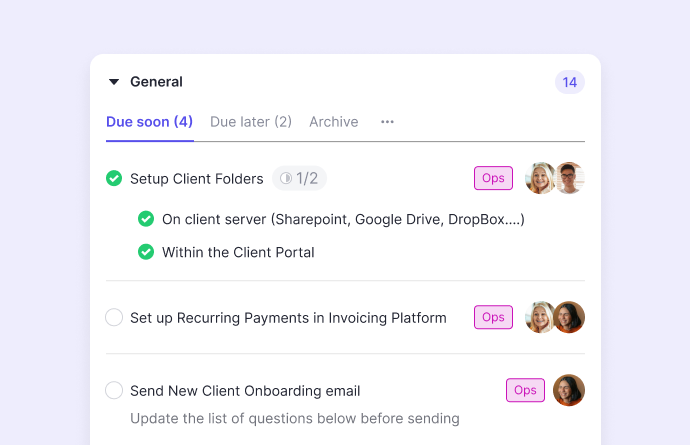

1. Integrate Your Task and Project Management

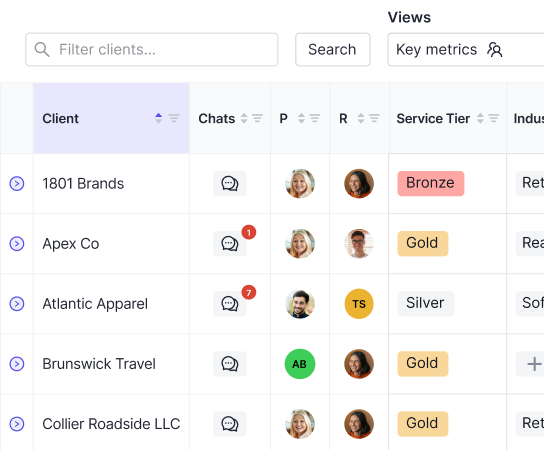

For many accountants, one of the biggest time drainers is simply spending too much time managing day-to-day tasks and big-picture projects. Say, for example, you assign someone on your accounting team an inventory or expenses task through a 3rd-party project management software like Asana or Trello. You have to jump back and forth between that platform and your accounting software to update those accounting tasks. This is incredibly inefficient and can lower productivity. However, using bookkeeping practice management software like Keeper lets you handle task management and project management from a single location. That way you can organize workflows in one place. You can conveniently track the progress of your clients closing and non-closing tasks from start to finish for full visibility and tighter collaboration. By using internal chat features, you can work through problems quickly and attach files right from within the platform to ensure nothing is missed.

You can conveniently track the progress of your clients closing and non-closing tasks from start to finish for full visibility and tighter collaboration. By using internal chat features, you can work through problems quickly and attach files right from within the platform to ensure nothing is missed.

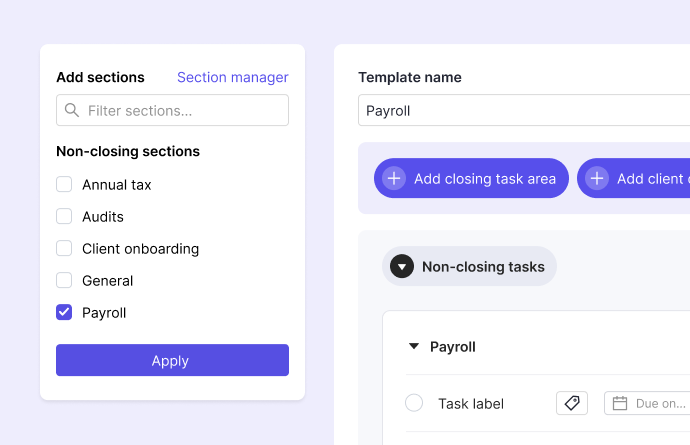

And by creating workflow templates, you can automate assigning tasks by re-applying them each month.

And by creating workflow templates, you can automate assigning tasks by re-applying them each month.

Whether you’re dealing with expenses, inventory turnover, receivable turnover, payable turnover, or any other accounting processes, this feature keeps things organized while eliminating repetitive tasks that are common with manual accounting.

Whether you’re dealing with expenses, inventory turnover, receivable turnover, payable turnover, or any other accounting processes, this feature keeps things organized while eliminating repetitive tasks that are common with manual accounting.

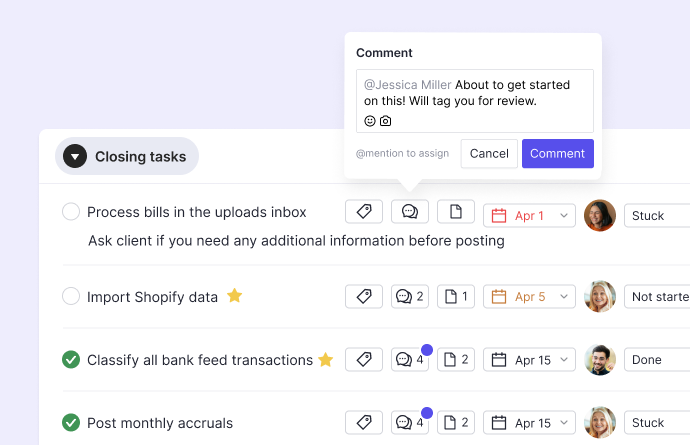

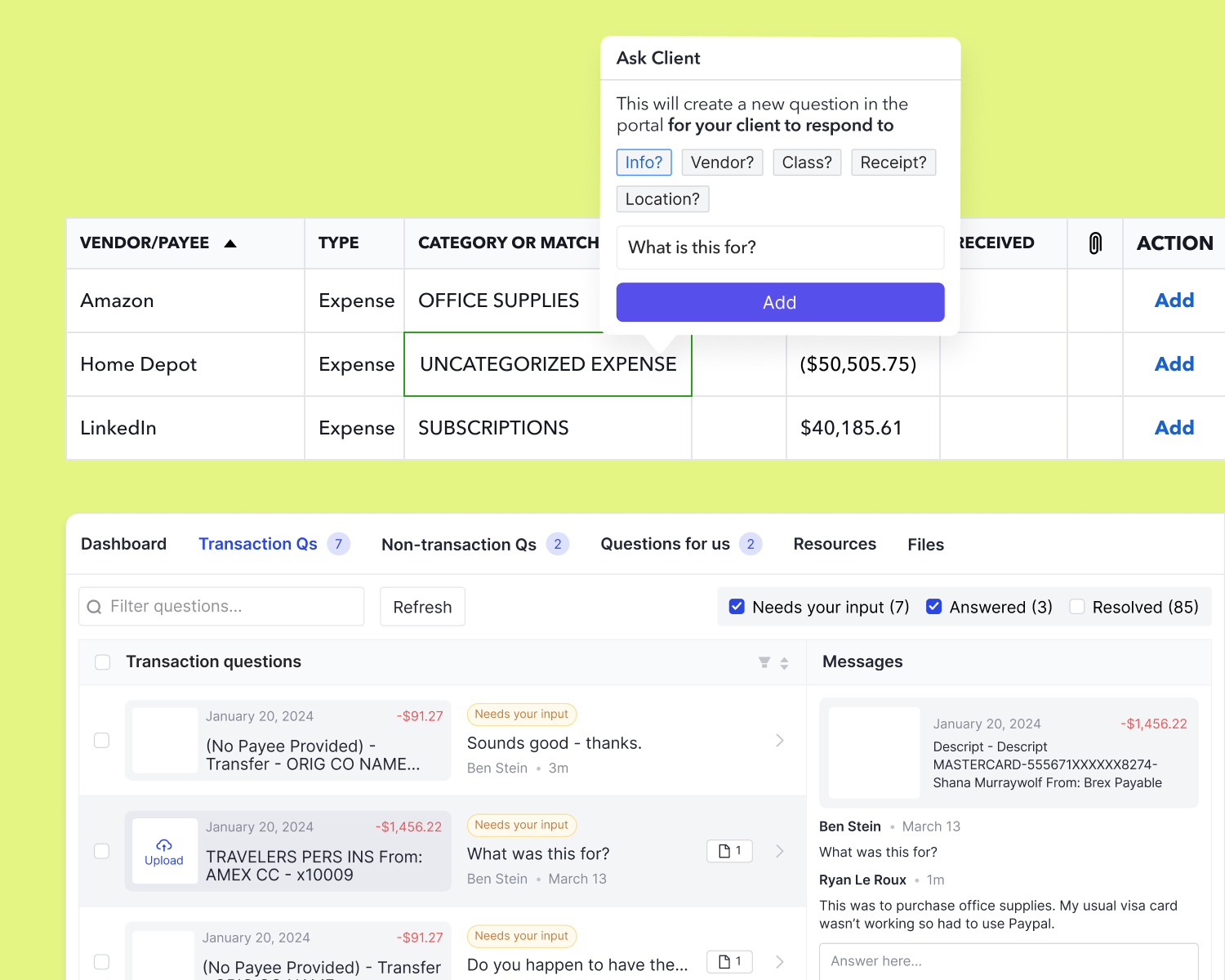

2. Streamline Client Communication

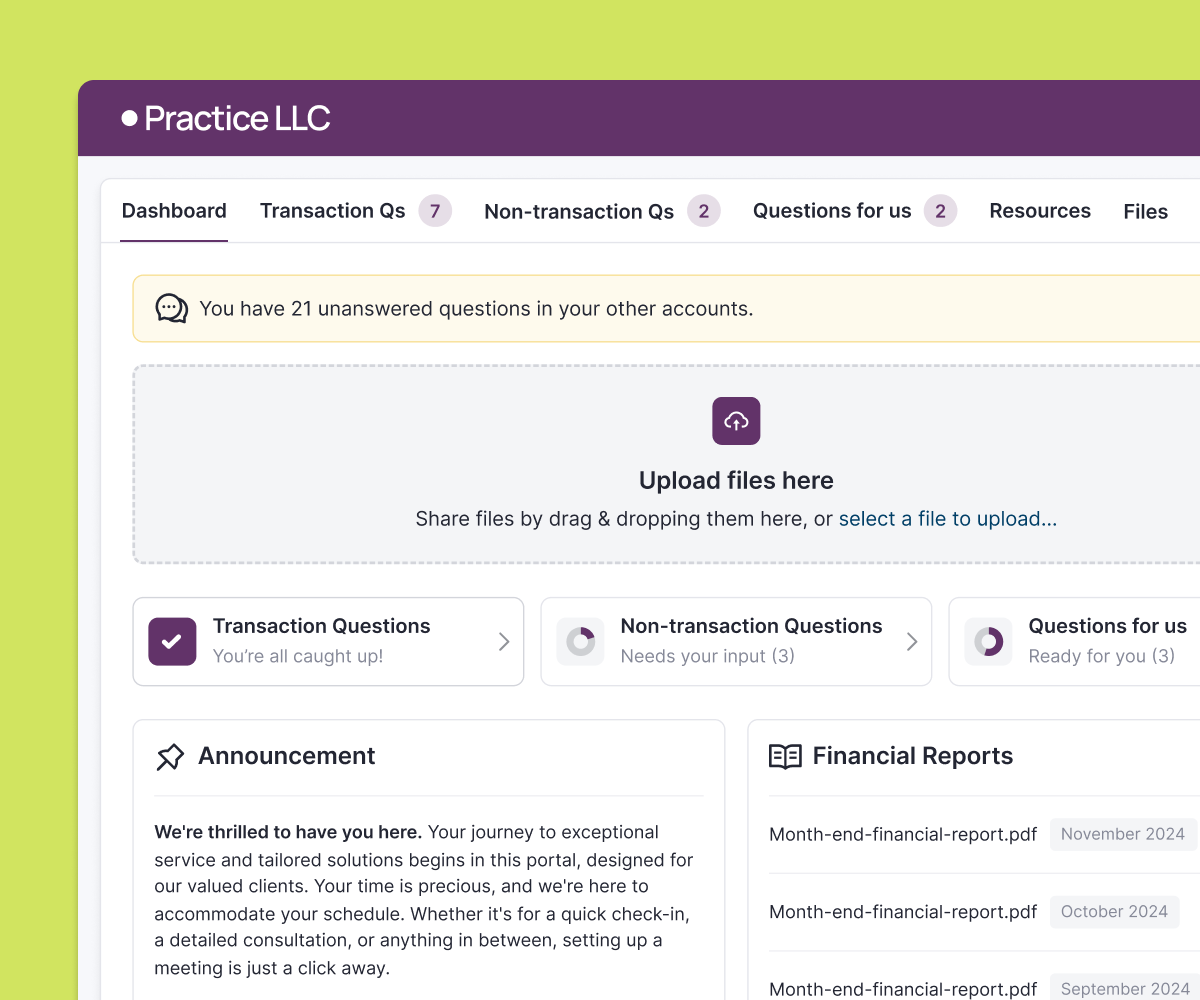

Like anyone in financial services, ongoing communication with all your business clients is extremely important to the success of an accounting practice. But there comes a point when you have to ask, “How much time is wasted because of inefficient client communication?” For many in the accounting industry, the number is uncomfortably high. Fortunately, we’re at a point where accounting automation can facilitate clear communication to ensure clients get the service they need without harming operational efficiency. Take, for instance, a custom-branded client portal. Here your accounting firm can manage all aspects of communication from a single, convenient location. You can centralize communication to ask questions and get responses, view financial data at a glance, and submit receipts and documents.

Here your accounting firm can manage all aspects of communication from a single, convenient location. You can centralize communication to ask questions and get responses, view financial data at a glance, and submit receipts and documents.

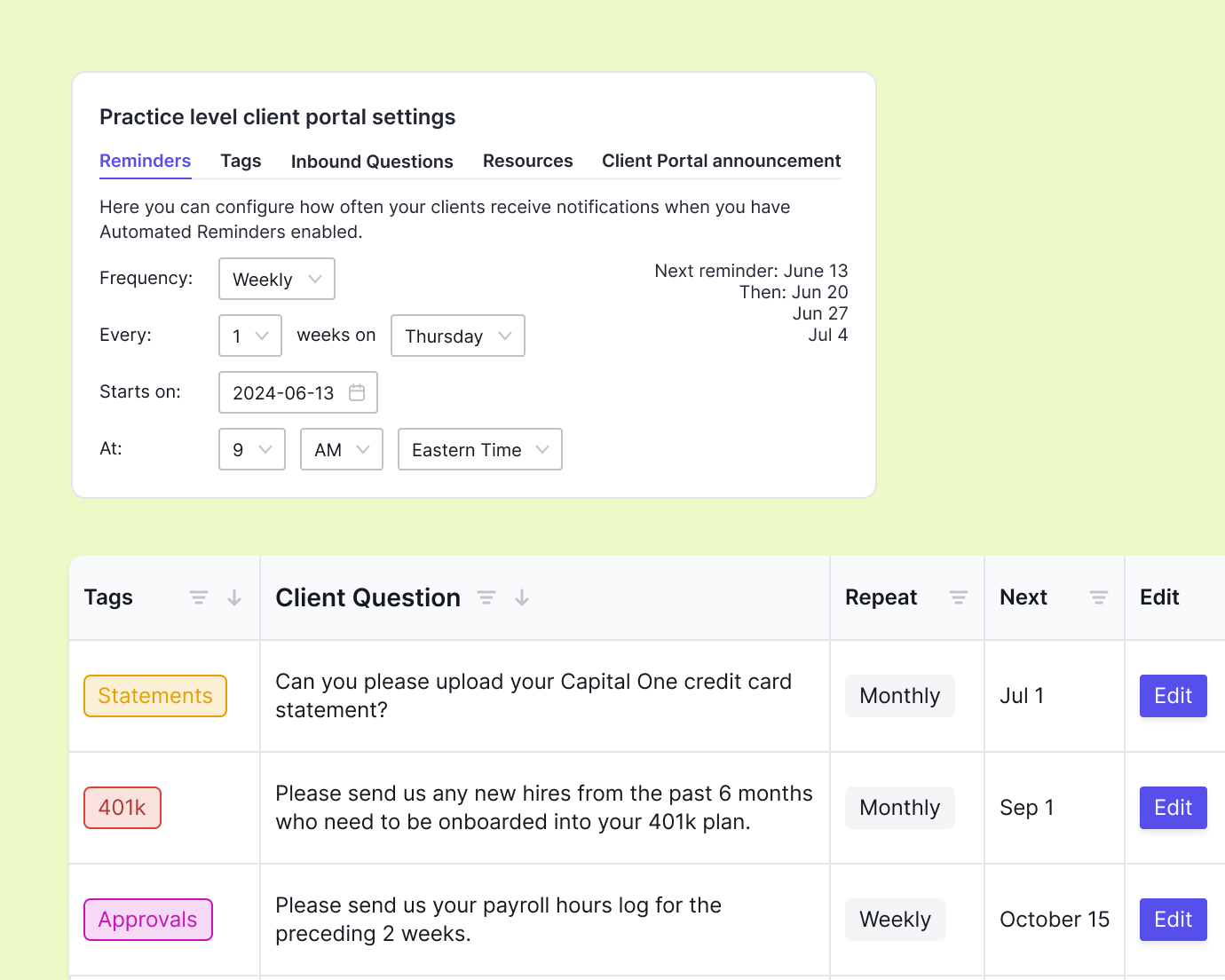

Follow-ups can be streamlined by an accounting professional creating scheduled requests and automating messages to obtain important client information quickly and efficiently.

Follow-ups can be streamlined by an accounting professional creating scheduled requests and automating messages to obtain important client information quickly and efficiently.

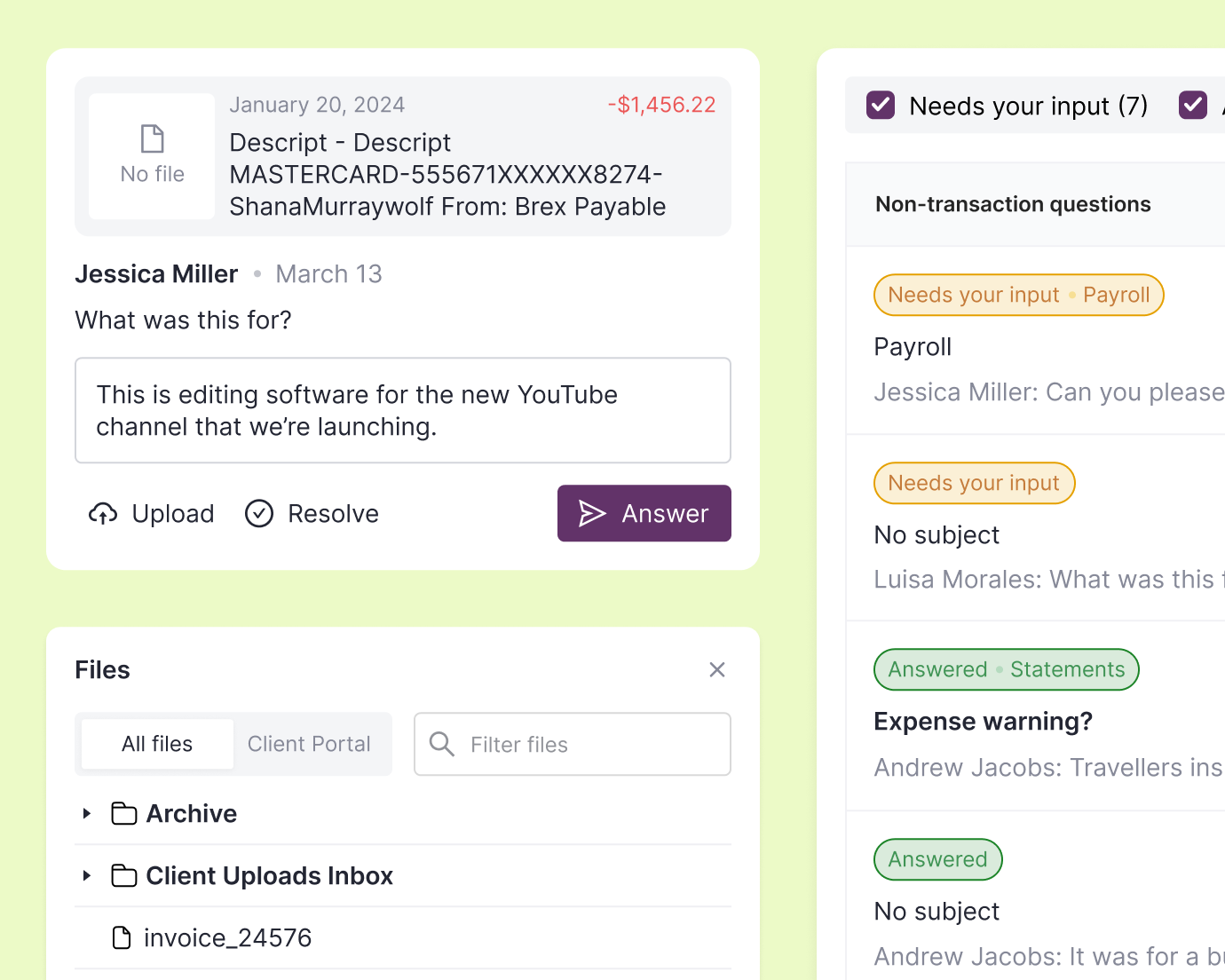

And when it comes to the dreaded spreadsheets, they can be eliminated by asking questions about a transaction right from within the bank feed, with your work from those answers automatically being synced to QuickBooks Online or Xero for maximum efficiency.

And when it comes to the dreaded spreadsheets, they can be eliminated by asking questions about a transaction right from within the bank feed, with your work from those answers automatically being synced to QuickBooks Online or Xero for maximum efficiency.

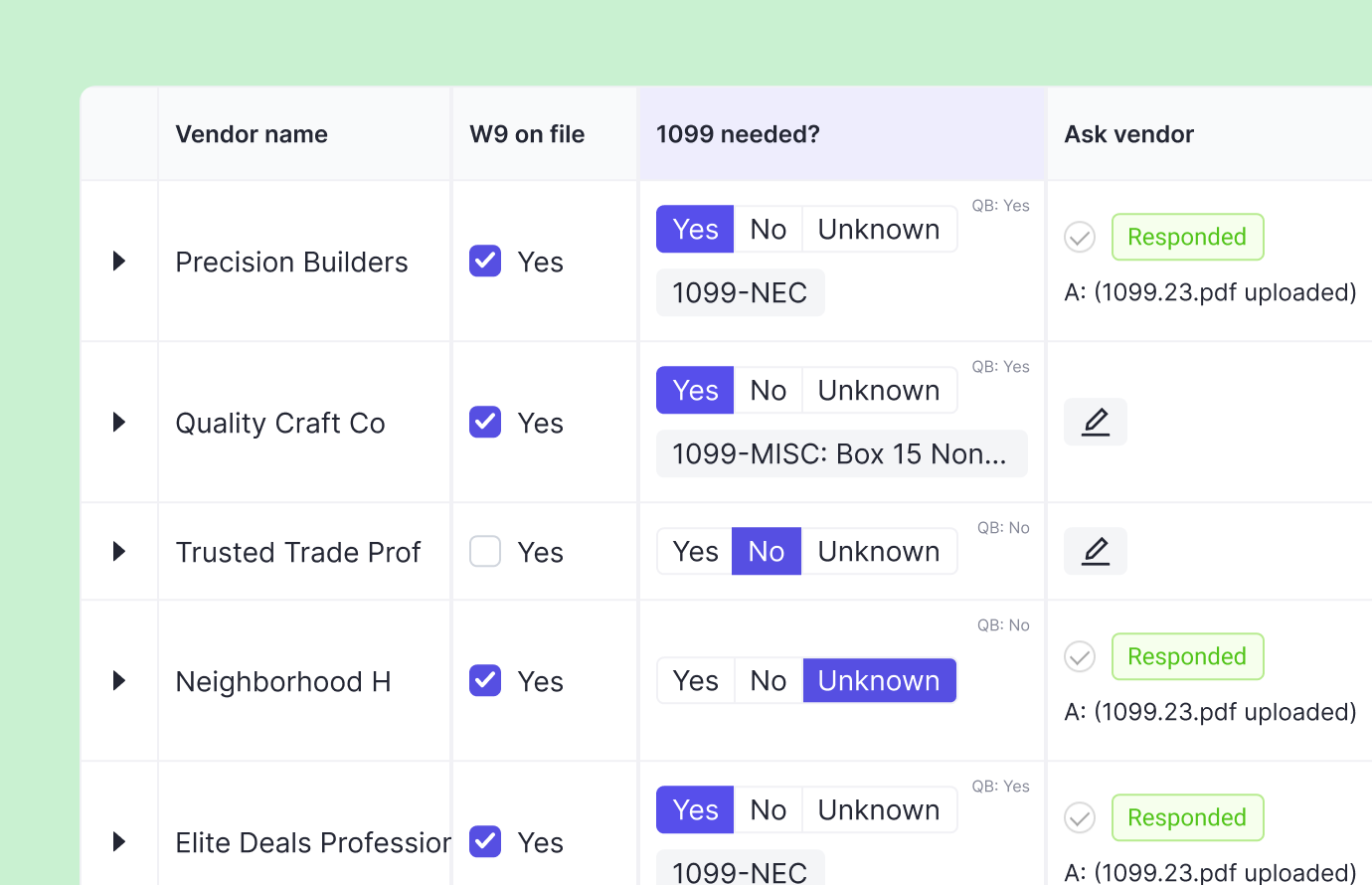

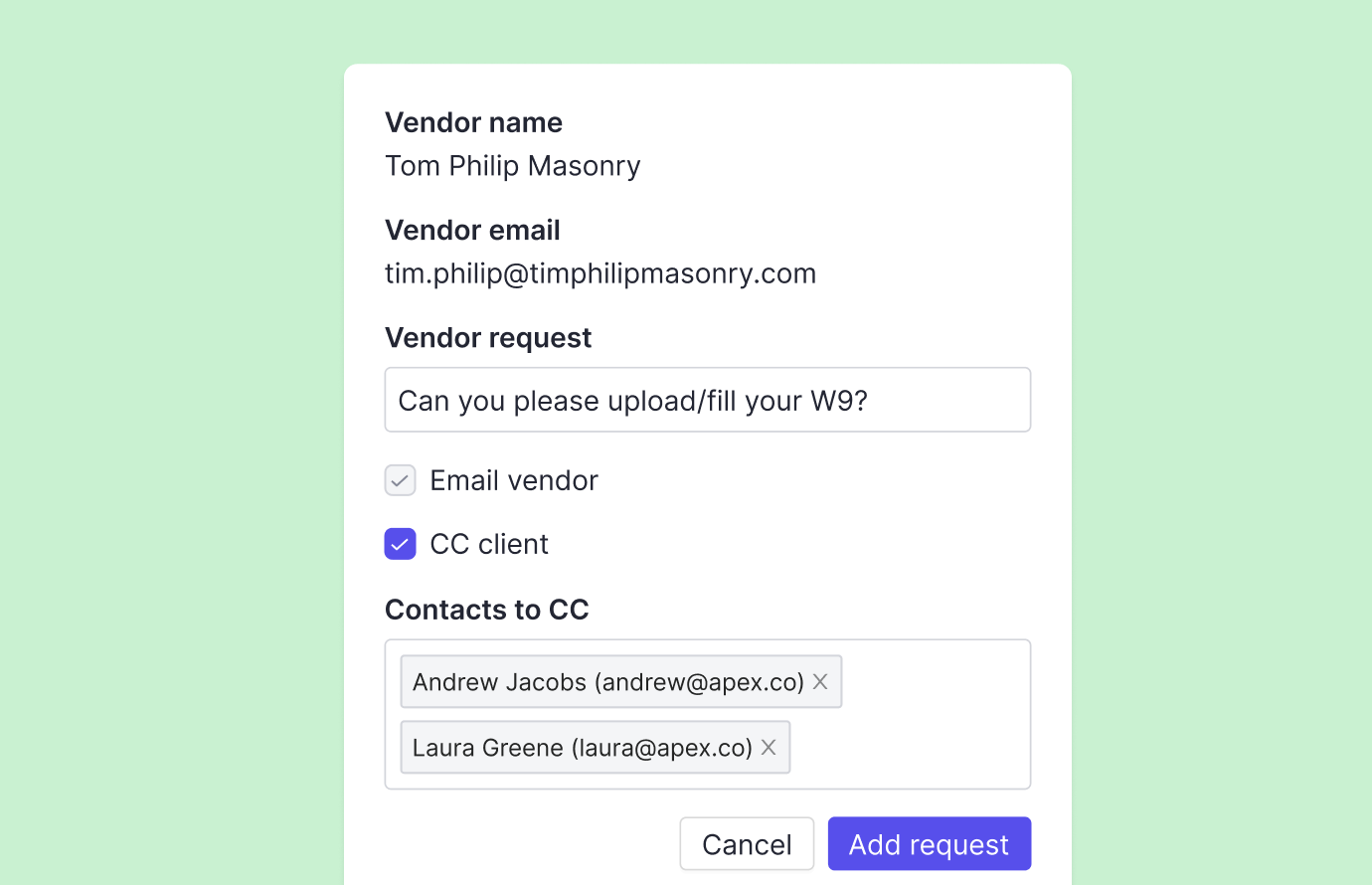

3. Automate W-9 Collection and Follow-up

Here’s the scenario. Your outsourced accounting firm sends out W-9s to client vendors so you can report their financial records to the IRS. However, you encounter vendors who either don’t care or don’t respond to your accounting team. This is one of the most hated parts of an accountant or bookkeeper’s job and can put a serious strain on productivity. If you’ve ever found yourself in this situation, you’ll be happy to know that there’s now a way to automate W-9 gathering, as well as follow-up, which can save you a ton of time when you’re running accounting services. With bookkeeping workflow software, the platform will automatically determine which vendors have reached the 1099 threshold by analyzing financial transactions. Once they’ve been identified, you can use the platform to quickly send out a request to reach out to them directly.

Once they’ve been identified, you can use the platform to quickly send out a request to reach out to them directly.

From there, you can easily track the progress from within the platform to see who’s completed their W-9 and who hasn’t. Keep in mind that you can either upload your own W-9 or use Keeper’s form-fill that generates a brand new one entirely for you.

Once the vendor has filled out the form, the information is automatically synced with QuickBooks Online or Xero, and it’s ready to go for far greater efficiency.

From there, you can easily track the progress from within the platform to see who’s completed their W-9 and who hasn’t. Keep in mind that you can either upload your own W-9 or use Keeper’s form-fill that generates a brand new one entirely for you.

Once the vendor has filled out the form, the information is automatically synced with QuickBooks Online or Xero, and it’s ready to go for far greater efficiency.

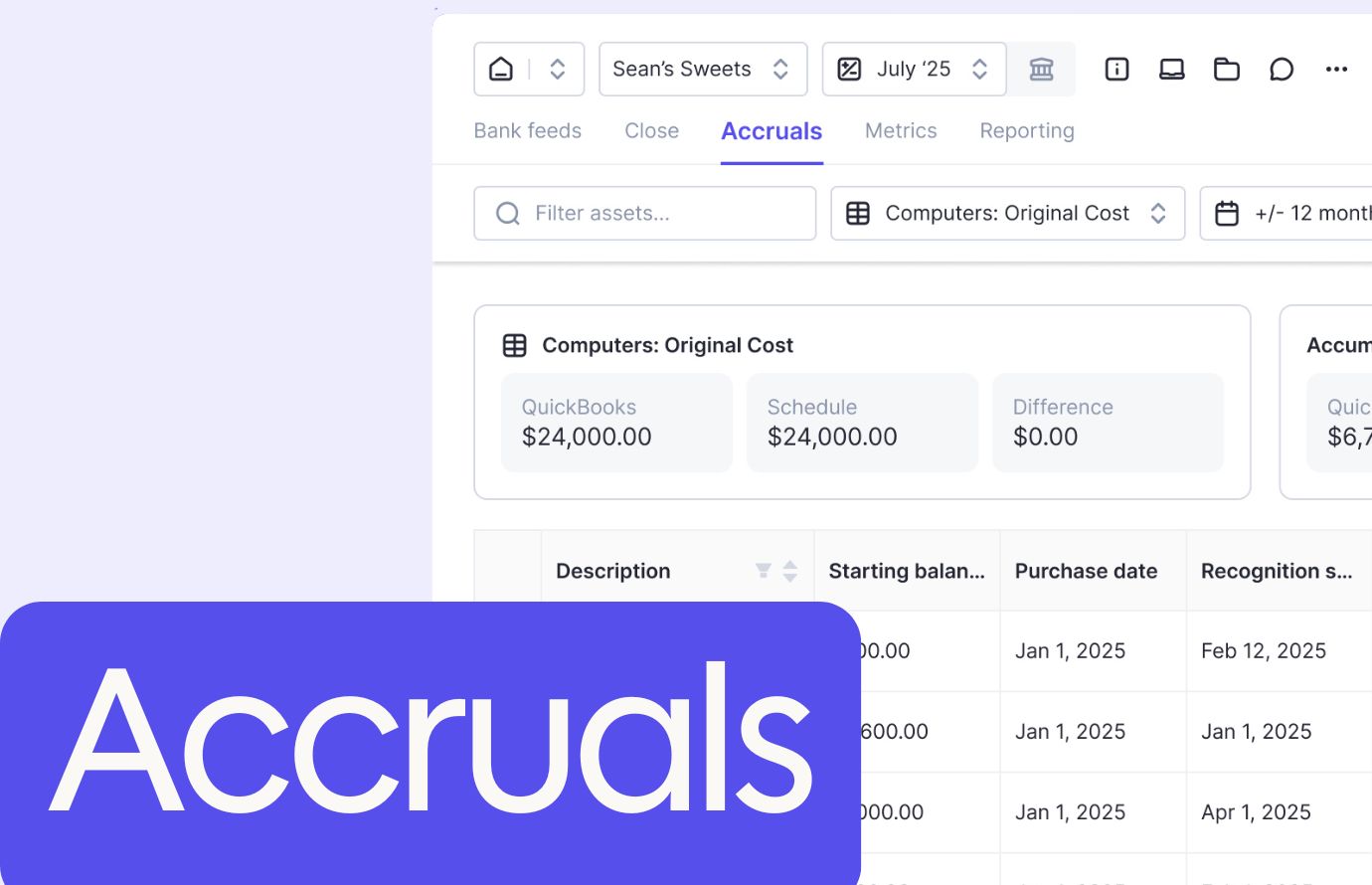

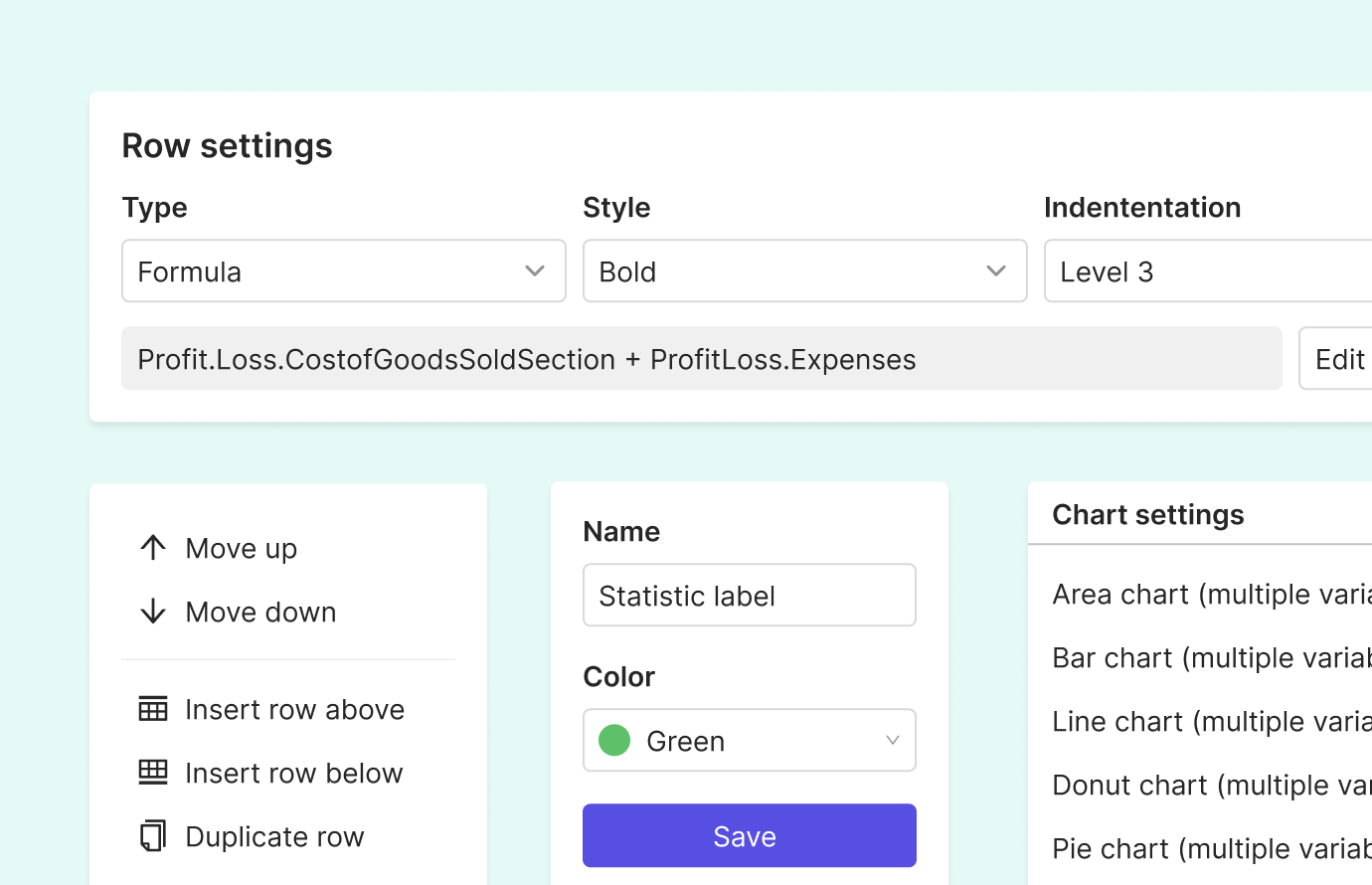

4. Automate Financial Reporting

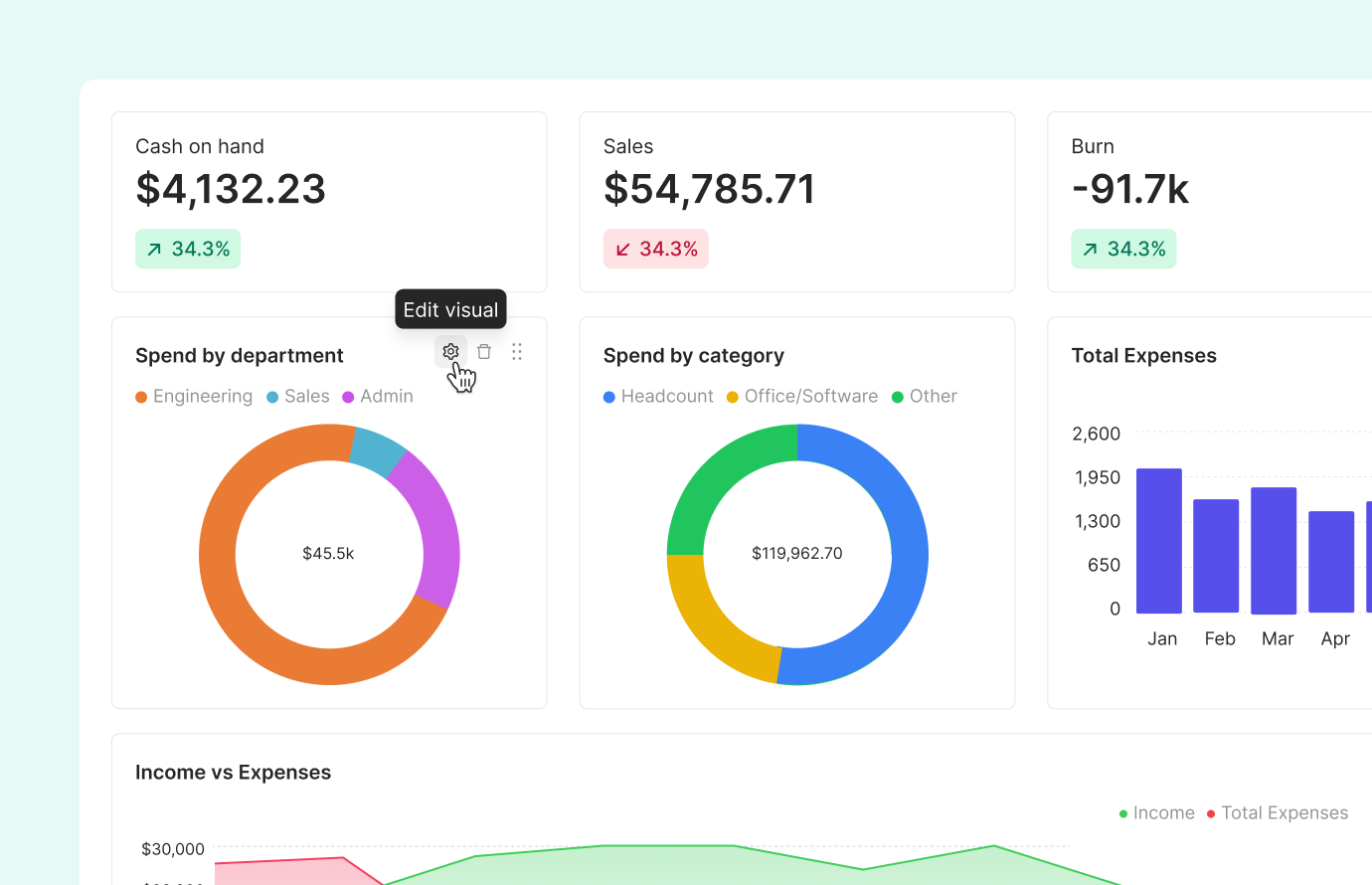

Producing accurate financial reporting on things like cash flow, assets, and expenses is critical to your finance team providing clients with high-level insights to guide their financial management decisions. However, generating and sharing this information with clients — especially in a way that’s easy for them to understand — is often easier said than done. And when you get “too much in the weeds” with a financial report, it can shave hours off your week. But this too is an area that can largely be automated for greater accounting efficiency. For instance, with Keeper, you can easily connect to your client’s ledger with just four clicks. You can then produce reports that are not only in-depth and measure what truly matters with assets and accounts but produce user-friendly reports with intuitive visuals. That way, your clients can make data-driven decisions without having to be data scientists.

You can then produce reports that are not only in-depth and measure what truly matters with assets and accounts but produce user-friendly reports with intuitive visuals. That way, your clients can make data-driven decisions without having to be data scientists.

And rather than having to send financial reports through email or a different platform, your accounting firm can publish them directly through a client portal with a single click.

If you’ve ever run into problems efficiently producing timely, accurate reports and found that it takes up more time than it should, this technology can be a breakthrough.

And rather than having to send financial reports through email or a different platform, your accounting firm can publish them directly through a client portal with a single click.

If you’ve ever run into problems efficiently producing timely, accurate reports and found that it takes up more time than it should, this technology can be a breakthrough.